Summary:

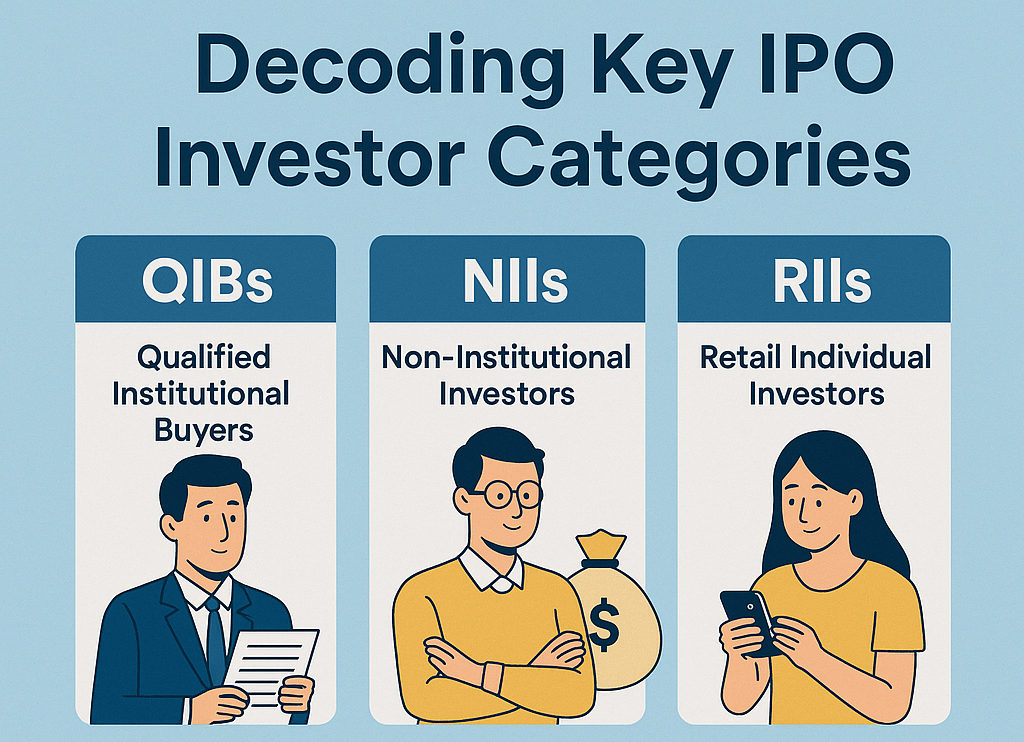

The main focus of the blog is to explain and decode key IPO investor categories – Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs) – to help readers understand their roles, share allocation quotas, and participation rules in IPOs. The blog aims to simplify IPO terminology for investors, highlight differences among these groups, and guide informed IPO investing decisions, with additional value offered through the IPOCornerr app for real-time IPO insights.

Introduction:

Taking a company public through an Initial Public Offering (IPO) is a significant milestone, and it’s a process filled with industry-specific jargon. If you’ve come across acronyms like QIB, NII, and Retail Investors while exploring IPOs – and found yourself lost in translation – this comprehensive guide is for you. At IPOCornerr, we believe every investor deserves clarity and confidence, whether you’re a first-timer or a seasoned participant.

Understanding Key IPO Investor Categories

1. Qualified Institutional Buyers (QIBs)

Qualified Institutional Buyers are institutional groups recognized by regulatory authorities, especially the Securities and Exchange Board of India (SEBI), for their financial expertise, scale, and regulatory compliance. They play a crucial role in IPOs, both by providing stability and signaling confidence to other segments of investors.

Who Counts as a QIB?

- Mutual funds

- Commercial banks

- Insurance companies

- Foreign portfolio investors (FPIs)

- Pension funds

- Public financial institutions

- Alternative investment funds (AIFs)

To qualify as QIBs, these institutions must meet stringent financial thresholds and regulatory criteria, ensuring they have the capacity and sophistication to assess and participate in large-scale share offerings.

Why Are QIBs Important in IPOs?

- Stability: QIBs anchor substantial portions of an IPO, providing financial solidity.

- Market Confidence: Their subscription level is often an indicator of the IPO’s credibility and potential. Heavy QIB interest frequently encourages robust participation from other investor groups.

- Regulatory Mandate: In most Indian IPOs, at least 50% of shares are reserved for QIBs, underlining their vital role in public offerings.

How Do QIBs Participate?

Shares for QIBs are typically allotted on a proportional basis, and once they submit an application, they cannot withdraw it before the IPO closes. Their significant investments often influence overall investor confidence and shape positive market sentiment during the IPO process.

2. Non-Institutional Investors (NIIs)

Non-Institutional Investors (NIIs) are a diverse group, comprising individuals or entities that apply for shares worth more than ₹2 lakhs in an IPO, but do not qualify as institutional investors (QIBs). This segment is often dominated by high-net-worth individuals (HNIs), corporates, trusts, and HUFs (Hindu Undivided Families).

NII Subcategories

SEBI has further split this category:

| NII Subcategory | Investment Amount |

| Small NII (sNII) | More than ₹2 lakhs, up to ₹10 lakhs |

| Big NII (bNII) | More than ₹10 lakhs |

Who Are the NIIs?

- High-net-worth individuals (HNIs)

- Corporates and companies

- Trusts and societies

- Partnership firms

- NRIs investing above ₹2 lakhs

Why Are NIIs Important?

- Substantial Quota: Indian IPOs reserve at least 15% of shares for the NII segment.

- Market Sentiment: Strong NII demand typically signals market optimism and reassures other investor categories.

- Flexible Strategies: NIIs may invest for the short-term (e.g., listing gains) or long-term growth, contributing to dynamic participation.

NII Allotment Rules

NIIs do not need SEBI registration but are subject to separate allotment and withdrawal rules. If oversubscribed, allotment is proportional. Otherwise, eligible applicants generally receive their full bid.

3. Retail Individual Investors (RIIs)

Retail Investors form the foundation of the IPO market – they are individuals who invest up to ₹2 lakhs in an IPO, making it accessible for everyday investors to participate in the public offering. This broad category includes salaried professionals, self-employed individuals, homemakers, students, and small-scale entrepreneurs.

Who Is a Retail Investor?

- A retail investor is any resident Indian or NRI who applies for shares worth less than ₹2 lakhs in an IPO.

- Households, joint applicants, and individuals investing via demat accounts

Retail Reservation and Application Process

- By regulation, a minimum of 35% of the shares in an IPO are allocated specifically for the Retail Individual Investor (RII) segment.

- Retail investors can bid at the “cut-off” price and can withdraw their bid during the IPO window.

- In case of oversubscription, shares are allotted by lottery – each applicant has an equal chance of receiving at least one lot, regardless of how many they apply for.

Why Retail Investors Matter

- Accessibility: Large number of small investors ensures wider ownership and democratizes wealth creation opportunities.

- Market Depth: Their enthusiastic participation often signals healthy retail interest in India’s equity markets.

- No Lock-In: Retail investors are free to sell shares immediately after listing – there’s no mandatory holding period.

Key Differences: QIB vs NII vs Retail Investors

| Criteria | QIB | NII | Retail Investor |

| Typical Applicants | Registered institutions (banks, mutual funds, etc.) | HNIs, corporates, trusts, etc. | Individuals, small investors |

| Investment Threshold | No specific minimum (often very large) | More than ₹2 lakhs (sNII: ₹2-10 lakhs; bNII: over ₹10 lakhs). | Up to ₹2 lakhs |

| SEBI Registration | Mandatory | Not mandatory | Not mandatory |

| IPO Reservation (India) | 50% | 15% | 35% |

| Application & Withdrawal | Cannot withdraw before issue closure | Limited withdrawal rights | Can withdraw until issue closure |

| Allotment Process | Proportionate | Proportionate or minimum bid size if oversubscribed | Lottery system if oversubscribed |

| Lock-in After Listing | Sometimes applies | Can sell post-listing | Can sell post-listing |

Practical Tips for IPO Investors

- Know Your Category: Apply under the correct segment according to your investment amount for better allotment chances.

- Monitor QIB & NII Interest: A heavily subscribed QIB or NII category often bodes well for IPO performance.

- Retail Strategy: For retail investors, apply at the cut-off price and consider multiple applications (family accounts) when possible for higher allotment odds.

- Beware of Oversubscription: When demand is high, be prepared for partial allotment or none at all, especially as a retail investor.

Take the next step: Install the IPOCorner app for instant IPO alerts, comprehensive analysis, and seamless investing!

FAQs

1. Who decides how many shares are reserved for QIB, NII, and retail investors?

The Securities and Exchange Board of India (SEBI) mandates IPO share allocation: at least 50% to QIBs, 15% to NIIs, and 35% to retail investors in most mainboard IPOs.

2. What happens if I apply as a retail investor for more than ₹2 lakhs in an IPO?

Your application will fall under the NII category, where allotment rules differ and you face a higher minimum investment threshold.

3. Can QIBs sell their shares immediately after listing?

In most cases, yes, but some IPOs require QIBs (including anchor investors) to hold shares for a specified lock-in period post-listing.

4. Why is QIB participation considered a strong signal for an IPO?

QIBs have market expertise and conduct strict due diligence, so strong QIB subscription often indicates high institutional confidence in the company’s prospects.

5. As a retail investor, is there any way to improve my allotment chances in an oversubscribed IPO?

You may improve your odds by applying for one lot across multiple demat accounts within your family, as allotment in the retail segment is often based on a lottery system.

Understanding the various categories of IPO investors is essential for navigating the public offering process. Whether you’re an institutional powerhouse, a savvy HNI, or a first-time retail investor, knowing how QIB, NII, and retail quotas work will help you make informed IPO investments. Welcome to smarter investing, with IPOCornerr as your guide!